The Only Guide to Truck Insurance In Dallas Tx

Table of ContentsInsurance Agency In Dallas Tx Can Be Fun For AnyoneHow Health Insurance In Dallas Tx can Save You Time, Stress, and Money.What Does Insurance Agency In Dallas Tx Do?The Buzz on Home Insurance In Dallas TxThe Buzz on Health Insurance In Dallas TxSome Known Details About Health Insurance In Dallas Tx

The premium is the amount you pay (generally regular monthly) for medical insurance. Cost-sharing describes the portion of qualified health care expenditures the insurance provider pays and also the section you pay out-of-pocket. Your out-of-pocket costs may include deductibles, coinsurance, copayments and the complete price of health care solutions not covered by the strategy.This type of health insurance policy has a high deductible that you have to meet before your health and wellness insurance coverage takes impact. These strategies can be right for individuals that desire to conserve cash with reduced regular monthly costs as well as do not prepare to utilize their clinical insurance coverage thoroughly.

The disadvantage to this type of coverage is that it does not fulfill the minimal necessary protection needed by the Affordable Care Act, so you may additionally go through the tax obligation fine. On top of that, temporary strategies can exclude protection for pre-existing problems. Short-term insurance policy is non-renewable, as well as does not consist of protection for preventative care such as physicals, injections, dental, or vision.

Commercial Insurance In Dallas Tx Fundamentals Explained

Consult your very own tax obligation, bookkeeping, or legal expert rather than relying upon this write-up as tax obligation, accounting, or legal advice.

You can commonly "leave out" any type of family member that does not drive your automobile, but in order to do so, you must submit an "exemption type" to your insurance company. Motorists who just have a Learner's Authorization are not called for to be listed on your plan up until they are completely certified.

The Facts About Health Insurance In Dallas Tx Revealed

You need to purchase insurance to shield yourself, your family, and your wide range (Insurance agency in Dallas TX). An insurance coverage could conserve you countless dollars in the occasion of a crash, health problem, or disaster. As you strike particular life milestones, some policies, including wellness insurance coverage and also auto insurance coverage, are virtually needed, while others like life insurance policy and impairment insurance coverage are highly urged.

Crashes, illness and disasters happen constantly. At worst, events like these can plunge you into deep monetary ruin if you do not have insurance to draw on. Some insurance plan are unavoidable (think: vehicle insurance in many US states), while others are simply a smart financial decision (think: life insurance policy).

Plus, as your life changes (state, you get a new job or have a baby) so should your coverage. Listed below, we have actually described briefly which insurance coverage you ought to strongly take into consideration purchasing at every stage of life. Note that while the policies below are organized by age, certainly they aren't good to go in rock.

Life Insurance In Dallas Tx Fundamentals Explained

Below's a short summary of the plans you require and also when you require them: Most Americans need insurance coverage to pay for medical care. Choosing the plan that's right for you may take some research study, however it acts as your very first line of protection against medical financial obligation, one of greatest resources of debt among customers in the United States.

In 49 of the 50 US states, drivers are called for to have car insurance coverage to cover any possible building damages and also physical injury that might result from an accident. Vehicle insurance rates are largely based upon age, credit browse around these guys rating, automobile make and design, driving document as well as area. Some states even think about gender.

The Single Strategy To Use For Life Insurance In Dallas Tx

An insurer will consider your house's place, along with the size, age and build of the residence to establish your insurance premium. Houses in wildfire-, twister- or hurricane-prone locations will certainly usually regulate higher premiums. If you market your house and go back to renting out, or make other living arrangements (Home insurance in Dallas TX).

For individuals who are maturing or handicapped and need assist with day-to-day living, whether in an assisted living facility or via hospice, lasting care insurance can help bear the exorbitant expenses. This is the type of point people do not consider up until they age as well as realize this may be a truth for them, but obviously, as you age you get more pricey to guarantee.

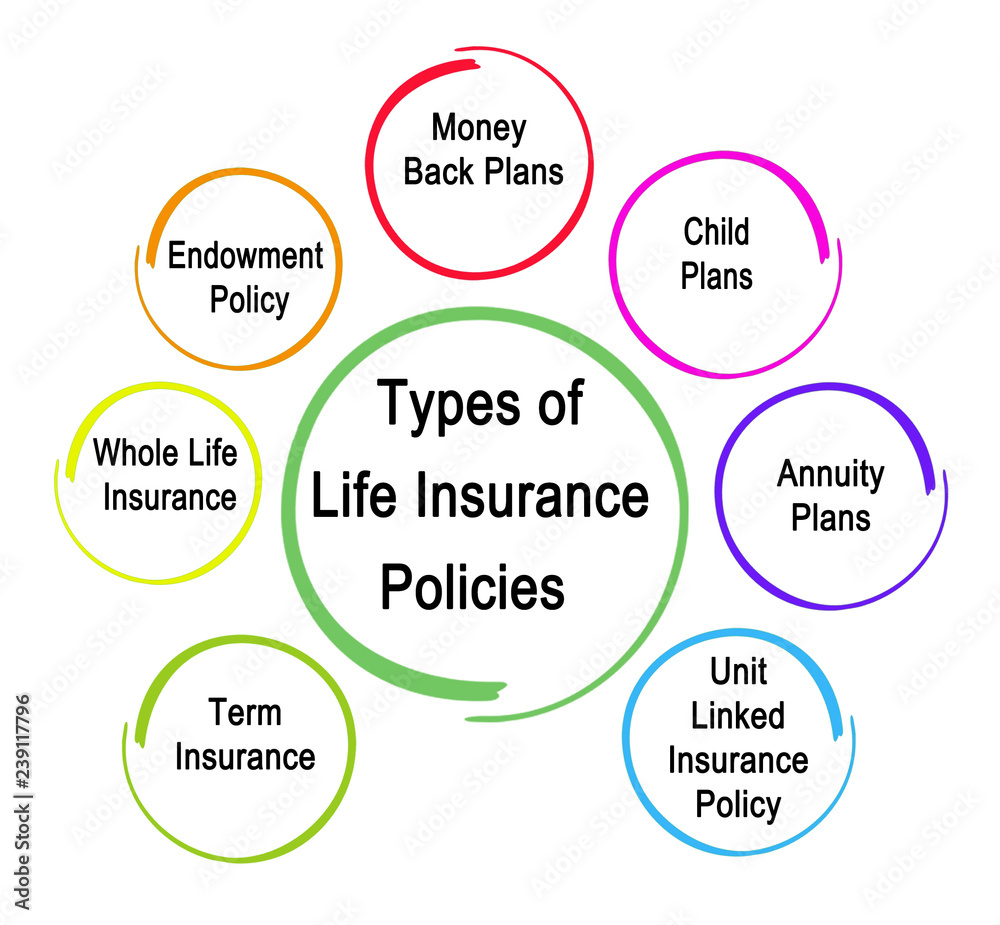

Generally, there are two sorts of life insurance policy prepares - either term or long-term plans or some mix of the 2. Life Visit Your URL insurance companies provide numerous forms of term strategies as well as conventional life plans along with "rate of interest sensitive" items which have become a lot more common because the 1980's.

The smart Trick of Health Insurance In Dallas Tx That Nobody is Discussing

Term insurance provides protection for a given amount of time. This period could be as brief as one year or give coverage for a particular number of years such as 5, 10, two decades or to a defined age such as 80 or in some instances as much as the oldest age in the life insurance policy mortality.

The longer the warranty, the greater the preliminary premium. If you pass away during the term period, the firm will certainly basics pay the face amount of the plan to your beneficiary.